HFT Arbitrage Getting Started

HFT Arbitrage is an automated trading system, the use of which requires some skills and knowledge in this area. This is not a money machine. First of all, it is a ready-made trading instrument capable of bringing money to an experienced trader.

As in any other business, making a profit depends only on your personal efforts and the desire to earn. You should not wait for short-term profits and hope for the help of others, you need to act independently and follow some instructions that our team has developed. For forex arbitration, the statement “money loves silence” is best suited.

HFT Arbitrage How to Start Earning?

If you are new to the market and have no work experience, then you will need at least 6 months to start earning. You also need an initial capital of at least 2000 USD to get started . You should not take money on credit and invest your last money in the trade. Risk warning is the first thing to start when working with highly volatile financial instruments, crypto currencies and stocks.

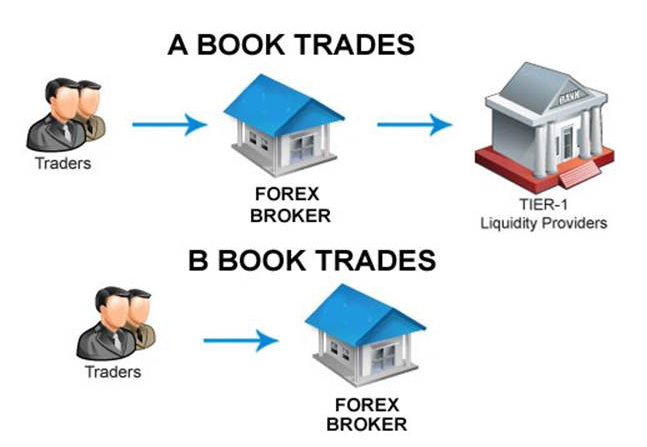

Do not forget that the Forex market, like trading on the stock exchange as a whole, is just a game. Here everyone has equal chances and big risks. This is a casino where you place bets first of all, and your winnings at any time can be canceled by the owner of the game. So are there any chances to win at the casino? How do you think? Is there any chance to win at the casino honestly? The answer speaks for itself; in order to earn you need to fool a broker and play against him, using the same methods he uses to take away your money. We will not disclose this topic in more detail, you can easily find it in other sources.

Let us dwell in more detail on the latency arbitrage trading strategy and possible options for making money on it. Where to begin? To recognize the presence of lagging quotes at the broker, you need special software. The human eye is able to perceive a change of information every 20 ms, and a trading robot can do it every nanosecond, which is hundreds of times faster. Our company has a variety of software products for arbitration and to get started you should purchase the appropriate tariff plan.

View a list of Software for HFT Arbitrage.

After payment, our customer support team will send you all the files you need to work.

The next step is to rent a VPS server. A list of suitable servers and prices can be found on the page VPS For Arbitrage.

User Guides

Included with the software files you will find detailed instructions for installing and configuring programs and advisers, but if you have a problem,

we can help you. You should not blame all the work on the employees of our company, as we have already written above,

in order to achieve results you must work on your own and understand everything in order to understand how programs and advisers work.

Detailed user instructions for launching and configuring software products:

Westernpips Trade Monitor 3.7 Guide

Westernpips FIX API Trader 3.9 Guide

Westernpips Analyser 1.3 Guide

Further, the main step is the selection and connection to a fast supplier of quotations. We have a huge variety of options and geolocation of liquidity providers and you should study each of them and choose the most suitable for you, focusing on the country of your residence and the presence of the minimum required initial deposit.

European liquidity providers:

USA liquidity providers:

If you do not have an opportunity to open an account with a fast supplier of quotes, you can use free quotes from our server (LMAX, RITHMIC) ,

and you can also connect quick quotes via expert advisors connectors, for example, from CQG terminal, where quotes are also very fast.

Further, the most difficult stage is the search and selection of brokers for work. Many brokers have the same quotes on a demo and a real account, so you can,

by testing a demo account, immediately understand whether this broker is suitable for arbitration or not. You can also test a broker without replenishing

a real account through Westernpips Analyzer 1.3, in which you can perform a graphical analysis of quotes, find gaps (quotes lagging), view saved log files

of signals (Excel and pictures) and further if the broker has a lot of lags and signals , replenish the real account and start trading.

Another way to test brokers is to replenish a real account with a minimum amount and test signals on a minimum lot.

How to check if the broker is suitable for arbitrage trading or is it worth searching for a new broker?

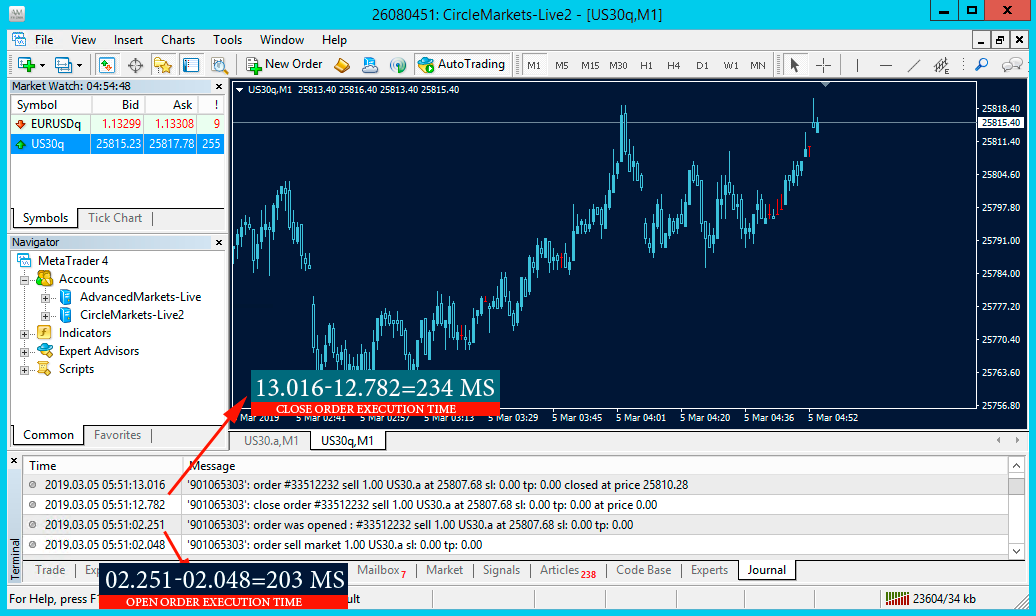

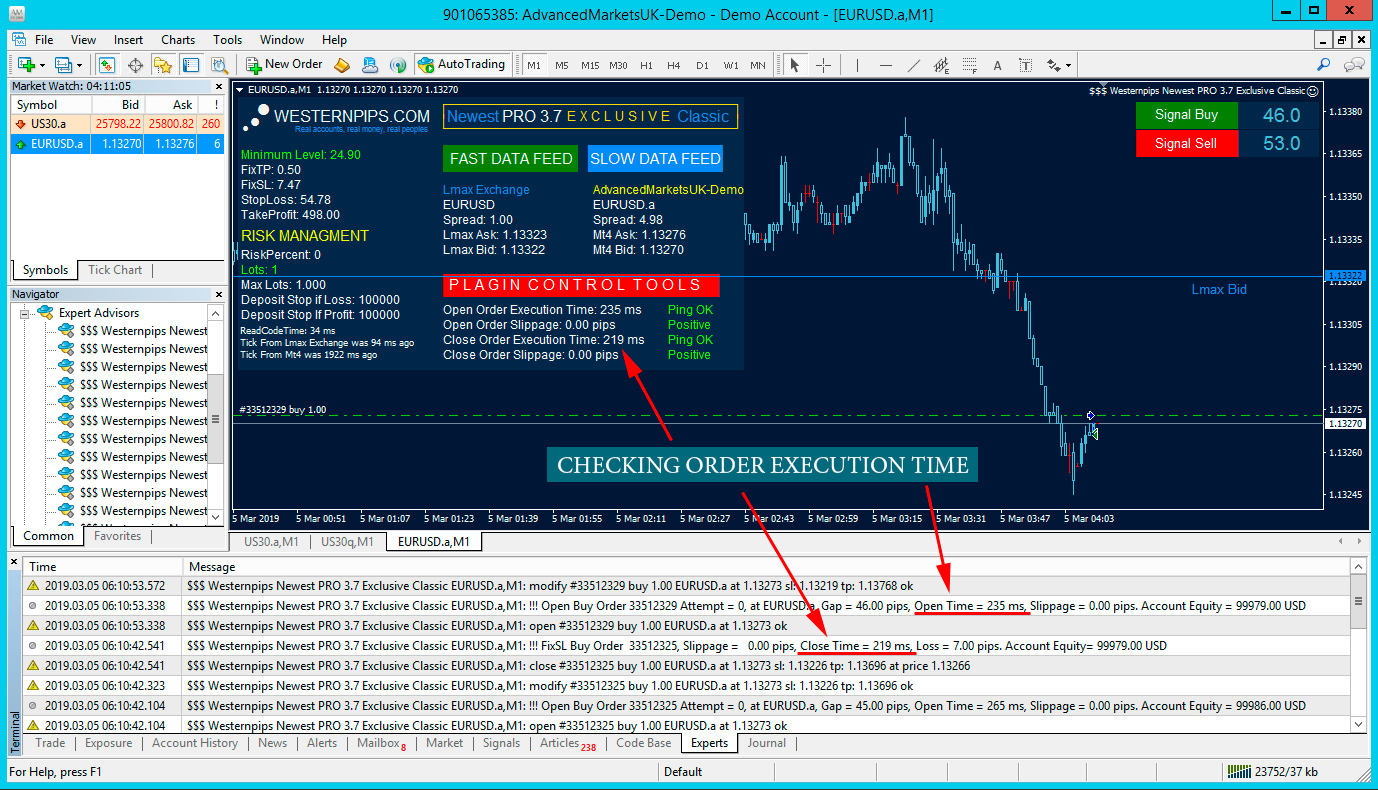

1. Order execution time (Execution Time). You can check the order execution time in two ways: open a test order with your hands or wait for the first transaction of the advisor Newest PRO 3.7 Exclusive. You can see more in the pictures below.

If the order execution time is more than 1000 ms, then the broker is not suitable for arbitration, or your account is already marked by the broker and your order execution time has increased. The Expert Advisor has a special block of settings <<< CONTROL EXECUTION PLUG-IN >>> where you can configure the control of order execution time and automatic trading stop in case of exceeding the set time limit for opening and closing an order.

2. Order execution price and slippage (Slippage) - this is also a very important parameter in arbitrage trading. Now many brokers use liquidity from several suppliers of quotes at once and your order can be executed at new prices (or market), in this case, the actual opening price of the order will differ from the price at which the adviser sent a request and calculated the signal and slippage will occur. Slippage = Request Price - Order Open Price

The amount of slippage should not be greater than the value of the gap (gap quotations) when opening a transaction. The ideal option for trading arbitrage is zero slippage, in this case you will get the maximum profit from the transaction in points. The more slippage, the less profit in points you have left. Due to slippage, dishonest brokers and kitchens earn and take away these items and your money in your pocket in addition to the spread and commission.

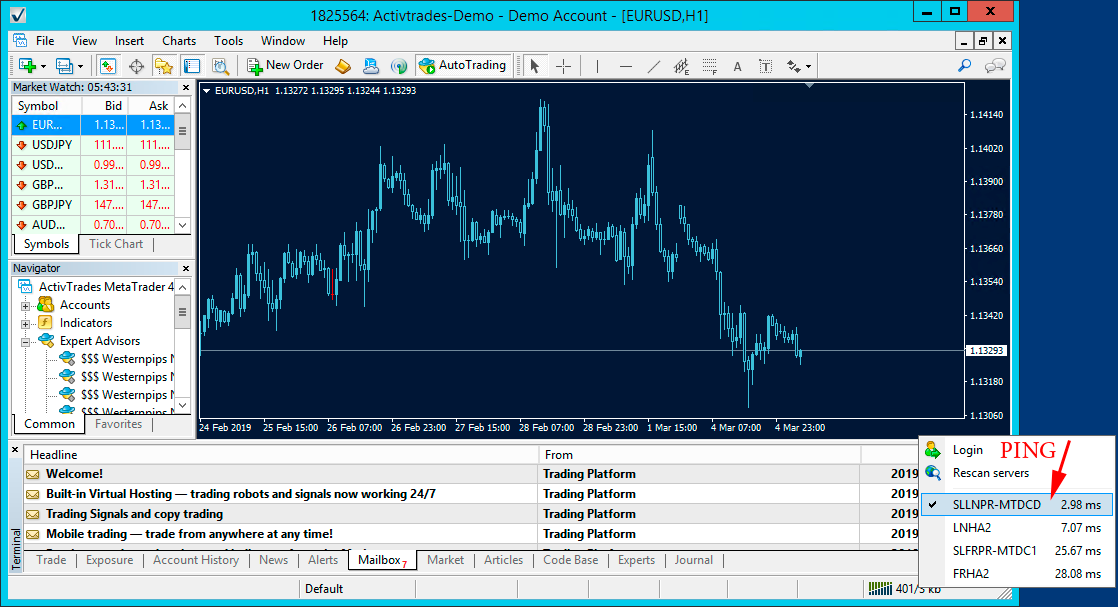

3. Check the ping with a broker and quotes provider. Time of execution of transactions and slippage directly depends on the ping with the broker's server. You can check the ping in the trading terminal on the taskbar in the lower right corner. You must select a server with a minimum ping and switch to it. Ping 0-10 ms is considered ideal. If you have more ping, then most likely the broker's servers are located in another data center and you need to rent a VPS server nearby.

You can check ping with a fast supplier of quotes in the Trade Monitor 3.7 program at the bottom of the quotes monitor or on the Check Your Ping tab (you can check ping with any server and IP). Ping 0 ms is considered ideal.

4. If you have a good ping with a broker and the time of order execution, as well as orders are executed with zero slippage or with little slippage, then the broker is suitable for arbitration and you should choose the optimal settings for your chosen tool and start earning! Description of the settings you will find in the User Guides.

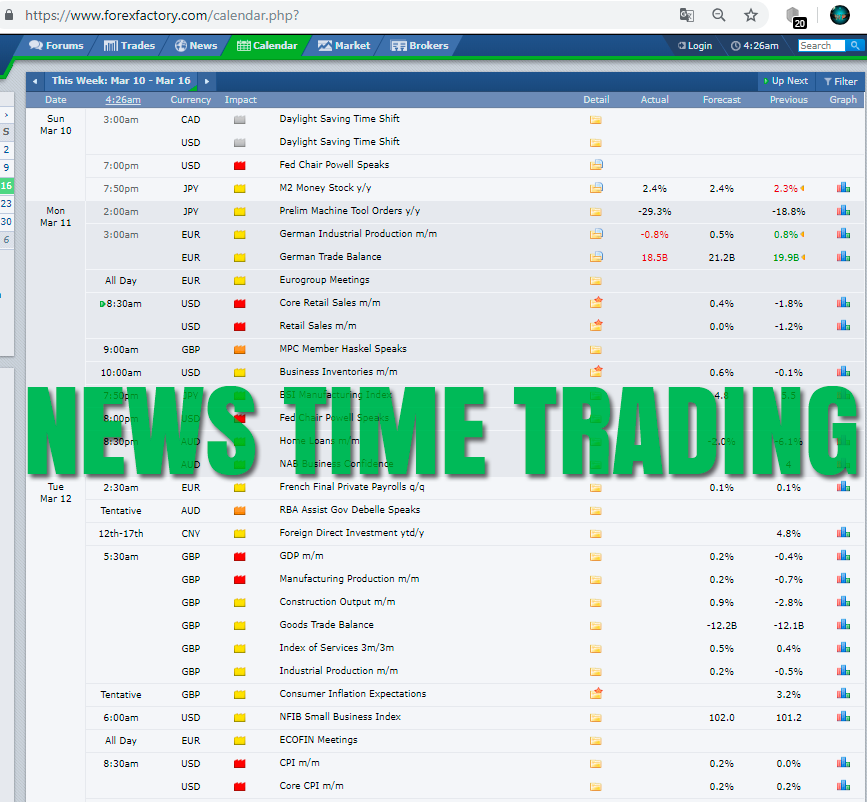

5. A good option for arbitration is trading in a period of high volatility and release of news data. At this moment, the brokers' servers are overloaded and there are even lagging quotes due to the large number of customer requests and order flow. The opening of the European and American sessions is also a great time to work as an advisor. News arbitrage is very popular and some prefer to trade only at this time.

6. If you find a good broker and start earning, be careful and follow the work of the adviser! If you achieve high profitability in your account in% and in the deposit currency, the broker can install plugins into your account and you need to stop trading and withdraw profits.