2 Leg Lock Arbitrage Strategy

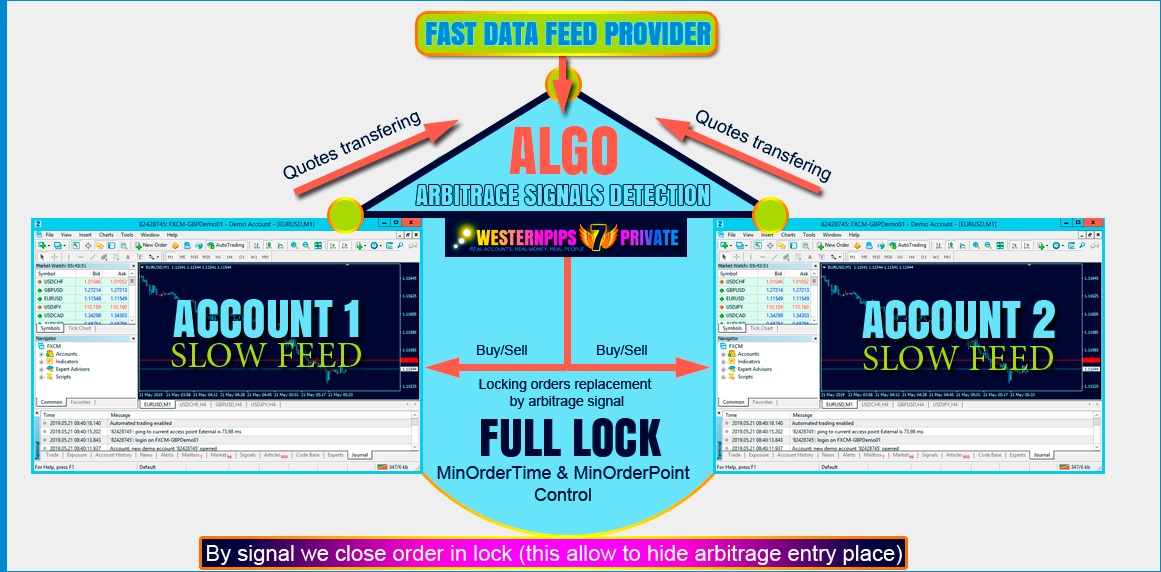

Algorithm 2 Leg Lock Arbitrage is the latest development of our programmers. The main purpose of creating this algorithm was a complete disguise and a completely new approach to arbitration.

The classic arbitration algorithm creates a fierce competition of players ahead of the prices at the entry point and there are less and less chances to execute a transaction without slipping.

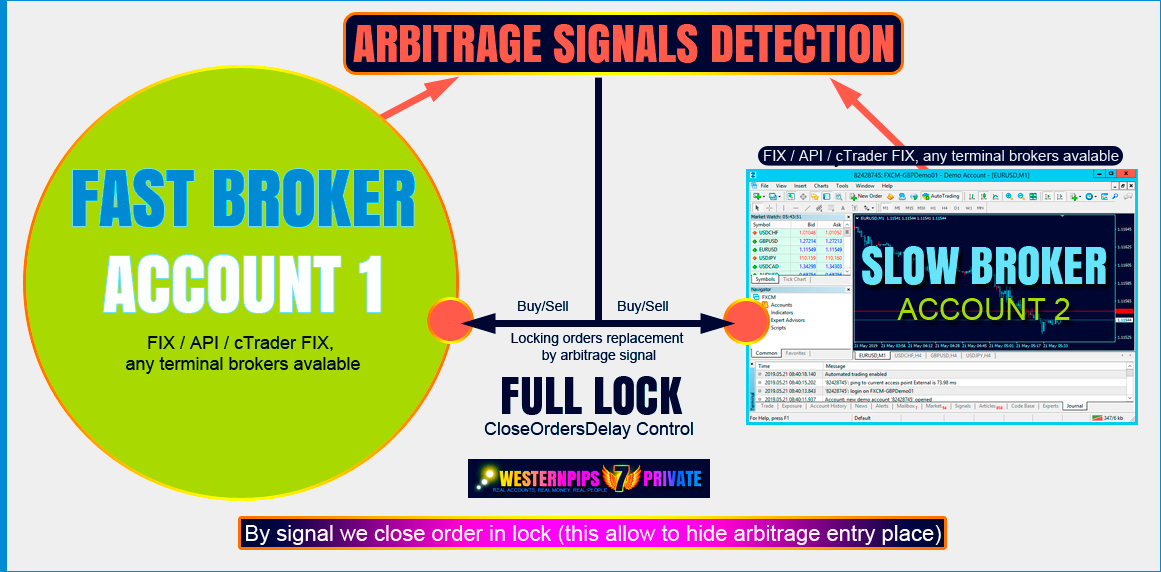

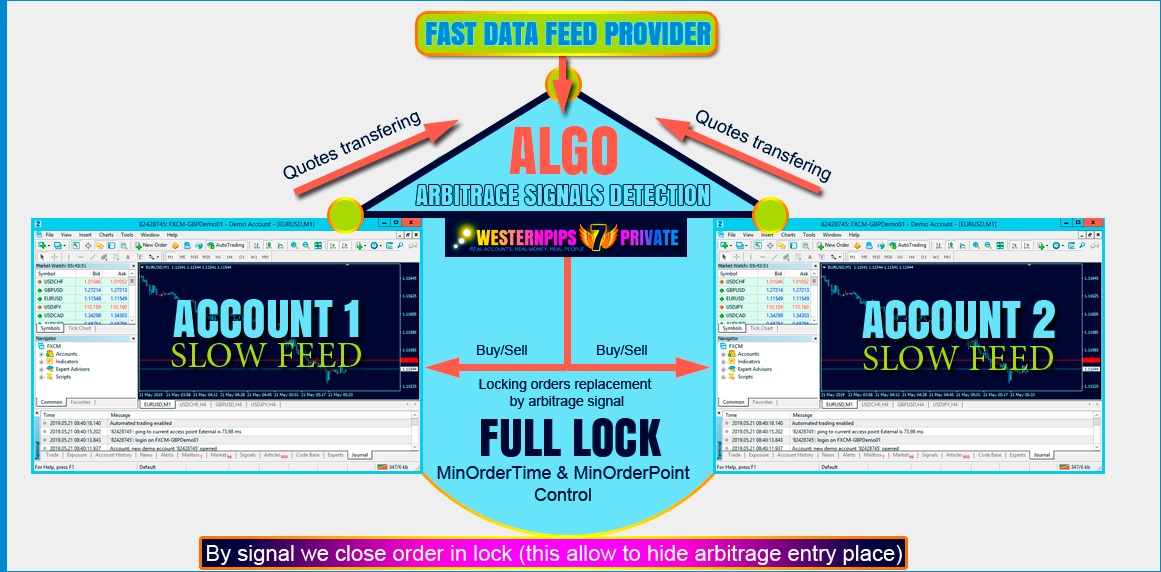

In order to solve this problem and at the same time preserve the profitability of the strategy, we developed a new algorithm in which the arbitration signal no longer serves as an entry

point into a deal, but rather, the signal closes a long-open deal. At the same time, trading is conducted in parallel on two different accounts of a slow broker (or on two different slow brokers).

The broker is less likely to recognize the use of arbitrage / scalping in your account because now the duration of all transactions exceeds the specified limits,

and the opening prices of transactions do not coincide with the price gap point, in the history of the account all transactions look chaotic - there are transactions with

a different number of profit points / loss and duration of time, and all this is a reliable method of masking and protecting your account.

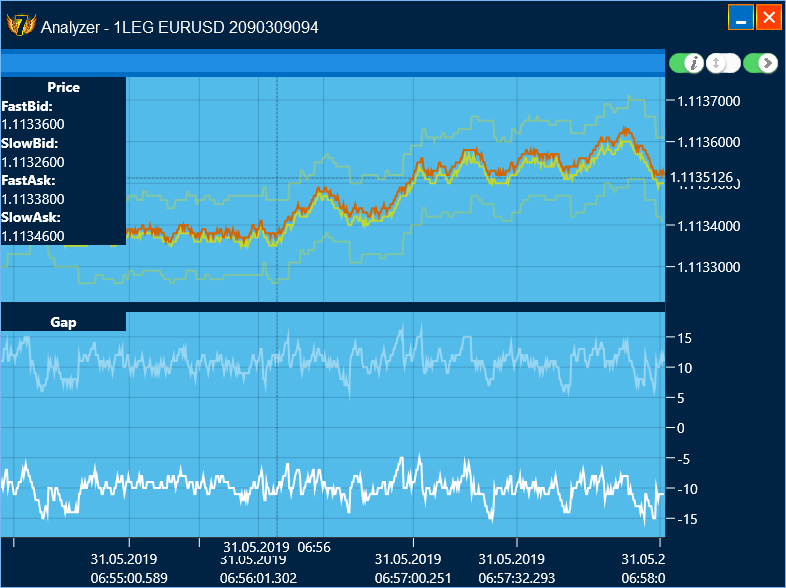

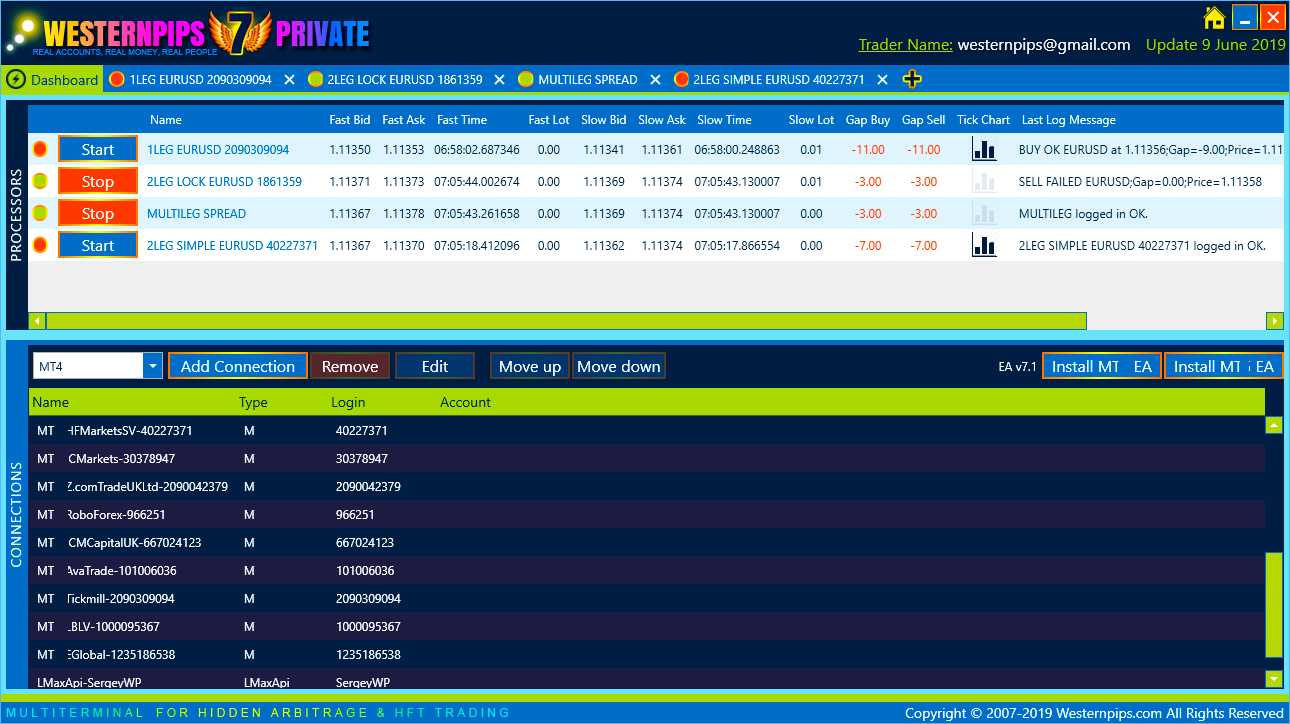

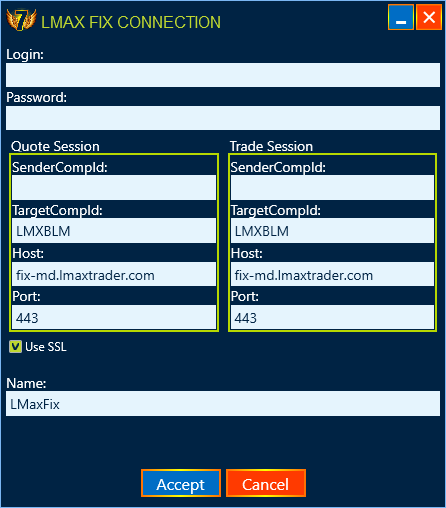

To obtain an arbitration signal, a fast supplier of quotations is used, and the transactions themselves are opened on different accounts / terminals of two slow brokers.

There is a smooth flow of capital between accounts and an increase in the total total deposit on two accounts.

The algorithm provides for the control of the direction of buy / sell / full lock orders on both accounts, as well as the control of possible risks.

Multi Leg Spread Arbitrage

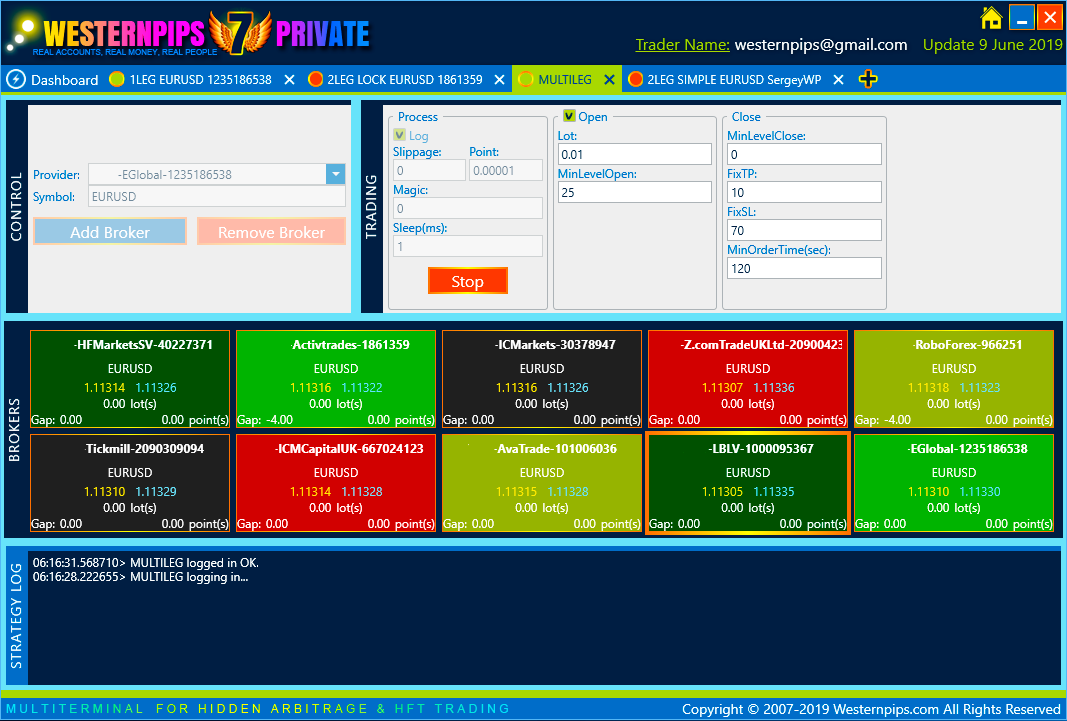

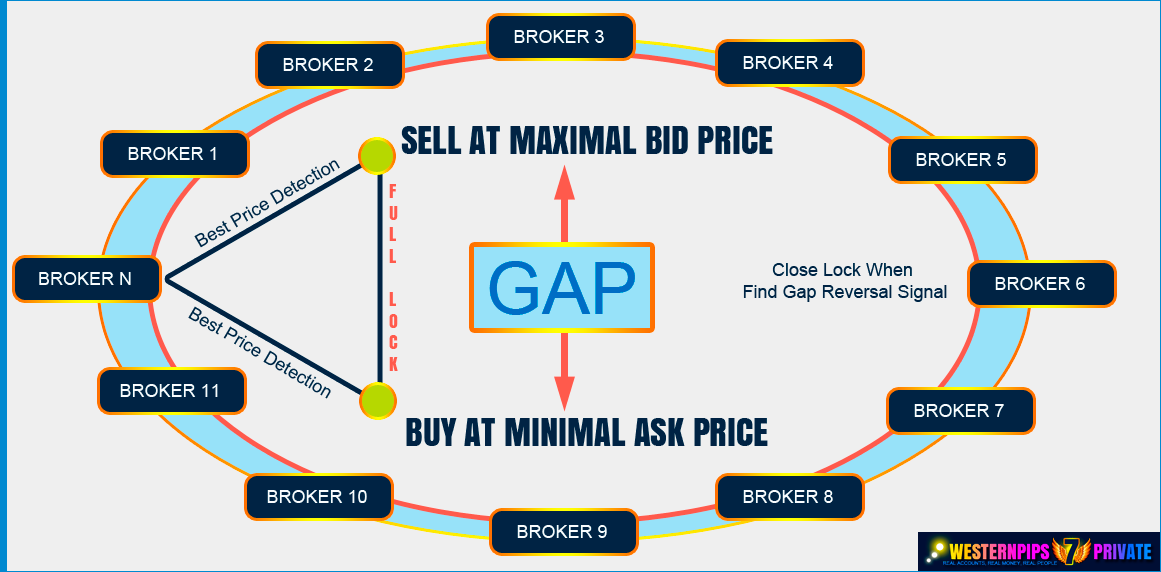

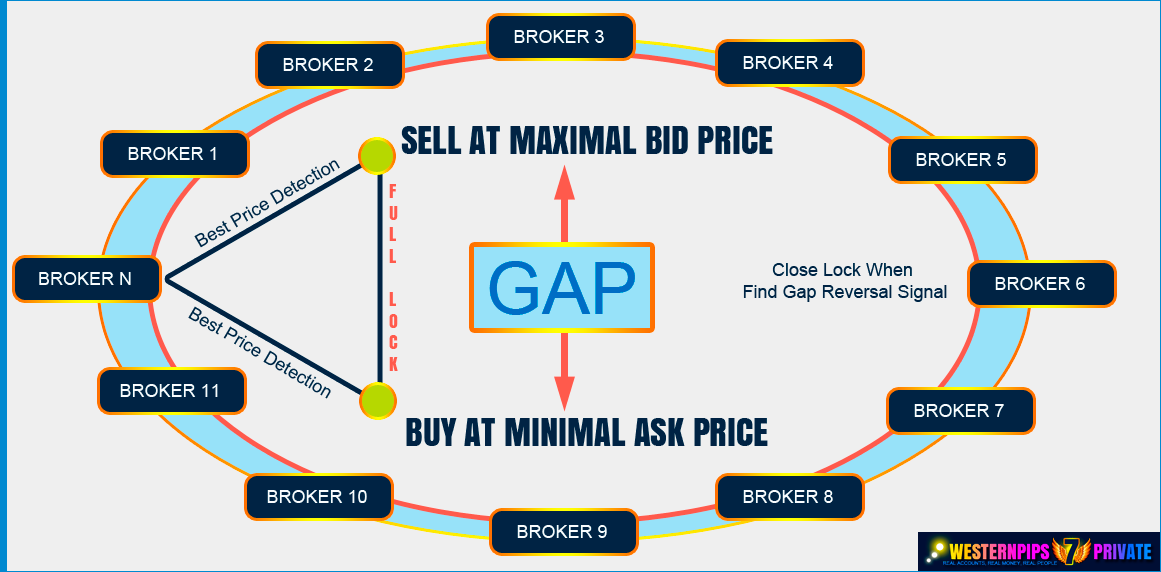

The Multi Leg Spread Arbitrage algorithm is a strategy for finding price discrepancies for different brokers / quote providers.

The discrepancy in prices must exceed the value of the spread for successful trading. This strategy is applicable to any trading instruments and our new algorithm

allows analyzing several different brokers at the same time and choosing the most advantageous price combinations for making deals.

The algorithm will select a pair of brokers from the ones you have added with the maximum difference in prices and open a BUY transaction at the lowest price

ASK and a SELL transaction at the highest price BID, profit will be obtained when prices return to their range or if the price diverges in the opposite direction.

This method is also called spread trading or correlation.

2 Leg Simple Hedge

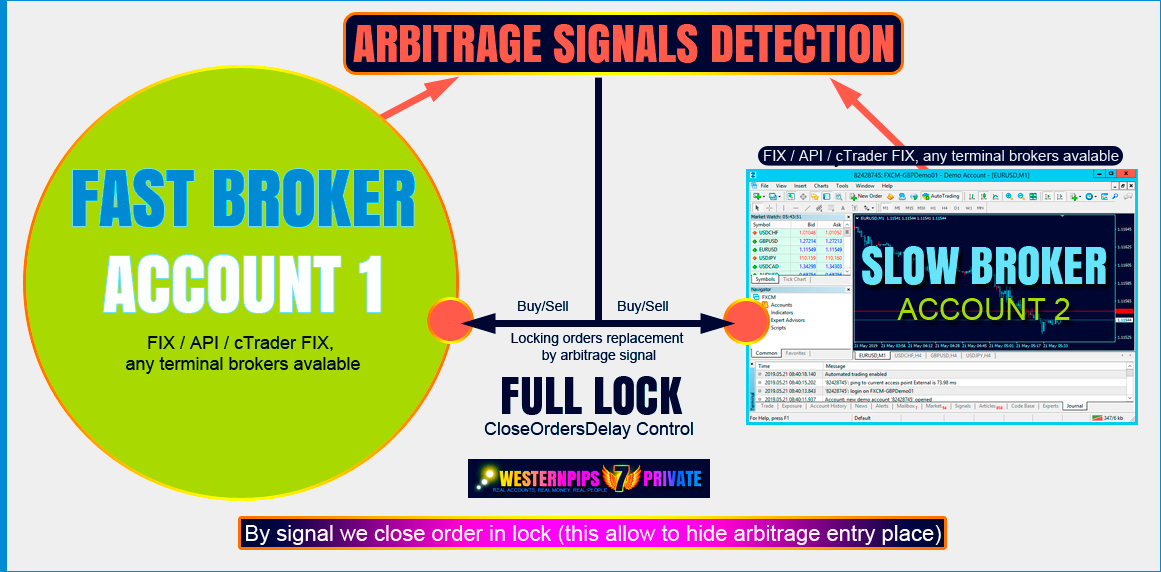

Strategy 2 Leg Simple Hedge is a very convenient and easy way to disguise transactions through a fast supplier of quotes.

A slow broker and a fast supplier of quotes are involved in trading where locking of transactions takes place to ensure protection of an account on a slow broker against blocking / banning.

The use of a new strategy allows you to control the duration of transactions by time and profit / loss in points.

The main innovation in the algorithm was the entry model in the transaction; now, at the signal of arbitration,

we do not open the transaction, but close one of the open transactions in the lock, which allows us to avoid slipping and hide the place of the arbitration entry from the broker's eyes.

To work with this strategy, you will need to have a deposit for trading at a fast supplier of quotes.